bestfootballer.ru

News

Consulting Versus Coaching

Coaching and consulting are two very different practices with contrasting approaches, relationships and goals. The difference between the two is the focus.” In other words, while a coach guides a client toward finding his or her own answers, a consultant fixes a problem. Coaching and consulting are typically seen as two different services that don't work together. You either get a coach. Coaching Vs Consulting: What's The Difference? (With Examples) · A coach focuses on asking questions and helping the person that they're working with form their. 1. Coaches ask questions. The biggest difference between coaching and consulting? Coaches guide you to the right answer tailored to your business, rather than. A coach is a thinking partner. They ask questions that lead you to self-discovery. They are not leading or directing you to the answers but helping you along. Coaching vs Mentoring vs Consulting? Question? Like stated in the title above; What's the difference between those three? Here you go. Someone I have met through a travel/digital nomad group has offered me coaching and consultancy to help me grow my business (either pay a flat fee or get a. What's the Difference Between Coaching & Consulting? ; Consultant brings technical expertise to advise on solutions, Coach brings relationship expertise to. Coaching and consulting are two very different practices with contrasting approaches, relationships and goals. The difference between the two is the focus.” In other words, while a coach guides a client toward finding his or her own answers, a consultant fixes a problem. Coaching and consulting are typically seen as two different services that don't work together. You either get a coach. Coaching Vs Consulting: What's The Difference? (With Examples) · A coach focuses on asking questions and helping the person that they're working with form their. 1. Coaches ask questions. The biggest difference between coaching and consulting? Coaches guide you to the right answer tailored to your business, rather than. A coach is a thinking partner. They ask questions that lead you to self-discovery. They are not leading or directing you to the answers but helping you along. Coaching vs Mentoring vs Consulting? Question? Like stated in the title above; What's the difference between those three? Here you go. Someone I have met through a travel/digital nomad group has offered me coaching and consultancy to help me grow my business (either pay a flat fee or get a. What's the Difference Between Coaching & Consulting? ; Consultant brings technical expertise to advise on solutions, Coach brings relationship expertise to.

Whether you choose a coach or consultant the intent is the same. Finding solutions and improving results. The coach is a guide helping your. The Difference Between Coaching and Consulting · What is a coach? a coach is someone who helps you identify your goals and develop an actionable plan to achieve. Consulting is conversations. This isn't true of course when you're more junior - there's a lot of “doing” work. But as you get more senior you realize that. The main difference between a coach and a consultant is that coaches are more focused on personal growth, while consultants are more goal-oriented. For example. When you coach, you explore possibilities. When you consult, you provide possibilities. Knowing the difference enables you to provide the greatest value to. Coaching and consulting are typically seen as two different services that don't work together. You either get a coach. Counselling is largely about solving problems, whereas coaching is all about reaching a greater potential. The biggest difference between coaching and consulting is who holds the power. In consulting the consultant holds the power in the relationship, while in. Scope of Practice: Similarities & Differences · Consultations are advice-giving interactions. · Counseling and Coaching both involve developing a trusting. Coaches empower clients to find their own solutions through self-discovery, while consultants are the experts who provide advice and actionable. A business coach acts as a supportive mentor, helping you increase your self-awarness, manage your mindset, set business goals, and develop strategies to. While coaching has a more personal and one-on-one approach, consulting is a more structured and data-driven type of guidance. Consultants offer businesses or. The biggest difference between coaching and consulting is who holds the power. In consulting the consultant holds the power in the relationship, while in. Coaching Vs Consulting: What's The Difference? (With Examples) · A coach focuses on asking questions and helping the person that they're working with form their. A business consultant is a subject matter expert whose job is to understand their clients' problems and provide solutions through hands-on strategy and. Coaching and consulting are two very different practices with contrasting approaches, relationships and goals. The Difference Between Coaching and Consulting · What is a coach? a coach is someone who helps you identify your goals and develop an actionable plan to achieve. Coaching helps in discovering. Consulting helps in execution. In coaching the coach helps the client to find the answers by him/herself. In. Coaching vs Mentoring vs Consulting? Question? Like stated in the title above; What's the difference between those three? Here you go. You will get a better understanding of the way the coach/consultant is operating when you sit down for the first time. I doubt that all coaches stay within.

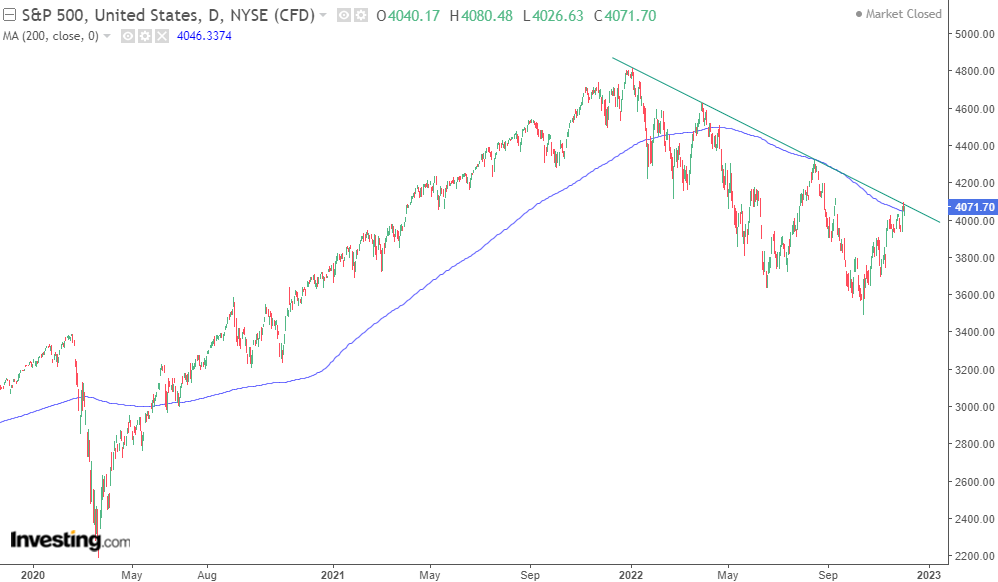

S&P 500 Forecast Today

RELIABLE S&P FORECAST. Daily Accurate S&P Trading Signals. 1 Hour, 4 Hour, Daily & Weekly Elliott Wave Counts. Live analysis sessions and trading. Historical and current end-of-day data provided by FACTSET. All quotes are in local exchange time. Real-time last sale data for U.S. stock quotes reflect. The S&P remains in an uptrend despite a recent pause. The index could head toward the all-time highs in case of a bullish open. Nasdaq , which ended. Over the next five years, the S&P is expected to see growth driven by innovation in technology and healthcare, increased consumer spending, and supportive. Stock Market Historical Trends. S&P Growth Paths · Stock Market Investment Styles. LargeCaps vs SMidCaps · Stock Market Fundamentals. S&P YRI Forecasts. Optimistic: 6%-7% per year. If you assume margins and P/E multiples will remain at their current high level, and expect sales and buybacks to grow at their. S&P index prediction on Tuesday, September, 3: , maximum , minimum S&P forecast on Wednesday, September, 4: , maximum , minimum Investors have paid higher prices over time to buy S&P and the index is in a rising trend channel in the medium long term. This signals increasing optimism. Get S&P Index .SPX:INDEX) real-time stock quotes, news, price and financial information from CNBC. RELIABLE S&P FORECAST. Daily Accurate S&P Trading Signals. 1 Hour, 4 Hour, Daily & Weekly Elliott Wave Counts. Live analysis sessions and trading. Historical and current end-of-day data provided by FACTSET. All quotes are in local exchange time. Real-time last sale data for U.S. stock quotes reflect. The S&P remains in an uptrend despite a recent pause. The index could head toward the all-time highs in case of a bullish open. Nasdaq , which ended. Over the next five years, the S&P is expected to see growth driven by innovation in technology and healthcare, increased consumer spending, and supportive. Stock Market Historical Trends. S&P Growth Paths · Stock Market Investment Styles. LargeCaps vs SMidCaps · Stock Market Fundamentals. S&P YRI Forecasts. Optimistic: 6%-7% per year. If you assume margins and P/E multiples will remain at their current high level, and expect sales and buybacks to grow at their. S&P index prediction on Tuesday, September, 3: , maximum , minimum S&P forecast on Wednesday, September, 4: , maximum , minimum Investors have paid higher prices over time to buy S&P and the index is in a rising trend channel in the medium long term. This signals increasing optimism. Get S&P Index .SPX:INDEX) real-time stock quotes, news, price and financial information from CNBC.

S&P (^GSPC). Follow. 5, (%). At close: August 26 at Why. United States Stock Market IndexQuote - Chart - Historical Data - News. Summary; Stats; Forecast S&P energy sector gaining over 1%, while technology. On the chart, the S&P remains in the overbought zone and there has been no real correction so far. Should this occur in the coming weeks, there will be. According to the latest long-term forecast, S&P value will hit by the end of and then by the middle of S&P will rise to within. S&P Forecast: Will Rate Cut Speculation Push US Indices Toward a Record High Today? SPX +%. USUSD +% · featured · FXEmpire minutes ago. The S&P finished lower on Monday, with AI heavyweight Nvidia dipping ahead of its quarterly report this week, while investors awaited inflation data for. The S&P ® is widely regarded as the best single gauge of large-cap U.S. equities and serves as the foundation for a wide range of investment products. S&P forecast for and beyond The average month price target stood at $, with a high forecast of $ and a low forecast of $ These. Economic Data, Rates & the Fed: · S&P Manufacturing PMI: , below the expected and down from the prior read of · S&P Services PMI: vs. The current value of S&P Index is 5, USD — it has fallen by −% in the past 24 hours. Track the index more closely on the S&P Index chart. S&P / US Dollar Forecast ; Current S&P (SPX) price $5, ; According to analytical forecasts, the price of SPX may reach $5, by the end of Today's news · US · Politics · World · Tech · Reviews and deals · Audio · Computing · Gaming S&P INDEX (^SPX). Follow. 5, (%). At close. Latest SPX News ; Wall Street Closes Week Higher After Fed Remarks. 2 days ago ; Stock Market News Today, 08/23/24 – Stocks Rally after Powell Hints at Rate Cuts. Historical and current end-of-day data provided by FACTSET. All quotes are in local exchange time. Real-time last sale data for U.S. stock quotes reflect. Historical Prices for S&P ; 08/02/24, 5,, 5,, 5,, 5, ; 08/01/24, 5,, 5,, 5,, 5, Optimistic: 6%-7% per year. If you assume margins and P/E multiples will remain at their current high level, and expect sales and buybacks to grow at their. What matter is that current PER are quite high at 28 currently. But 25 or 30 would be very similar: that make stocks expensive. So either we. Key Levels: Pivot Line: 5, - Resistance Lines: , , - Support Lines: , , Today's Expected Trading Range: The price is expected to. Stock Market Historical Trends. S&P Growth Paths · Stock Market Investment Styles. LargeCaps vs SMidCaps · Stock Market Fundamentals. S&P YRI Forecasts.

How Much Do Dealers Give You For Trade Ins

It's the process of selling your current vehicle to the dealership and putting the money toward the purchase price of another car. Browse Multiple Makes and. I only managed to get $11, for a trade in after an initial offer of $10, Now I looked on the dealer's website and see them trying to sell. Essentially, what you do is sell your used car to the dealer, and the amount they pay gets taken off the value of whichever vehicle you want to buy. makes selling used car much more lucrative. With used cars, dealers pay you for your trade-in, then recondition the car with a tune-up and detailing and. Dealerships often claim that a trade-in is the best option because it saves significant time and effort. That may have been true in the past, but today, selling. For example, if you buy a $50, car and the dealer gives you $15, for your trade-in, you'll only pay tax on $35, instead of the full $50K. In a location. Trade-in value is the dealer's price you get for your car when buying another vehicle from the dealership. The amount that dealers spend on marketing differs widely depending on where you are and what the dealer actually does to market their cars, but maybe $ is. They offer wholesale value, which is $1, $6, less than market value. This is so they can sell your trade-in and make a profit. Dealers make it appear. It's the process of selling your current vehicle to the dealership and putting the money toward the purchase price of another car. Browse Multiple Makes and. I only managed to get $11, for a trade in after an initial offer of $10, Now I looked on the dealer's website and see them trying to sell. Essentially, what you do is sell your used car to the dealer, and the amount they pay gets taken off the value of whichever vehicle you want to buy. makes selling used car much more lucrative. With used cars, dealers pay you for your trade-in, then recondition the car with a tune-up and detailing and. Dealerships often claim that a trade-in is the best option because it saves significant time and effort. That may have been true in the past, but today, selling. For example, if you buy a $50, car and the dealer gives you $15, for your trade-in, you'll only pay tax on $35, instead of the full $50K. In a location. Trade-in value is the dealer's price you get for your car when buying another vehicle from the dealership. The amount that dealers spend on marketing differs widely depending on where you are and what the dealer actually does to market their cars, but maybe $ is. They offer wholesale value, which is $1, $6, less than market value. This is so they can sell your trade-in and make a profit. Dealers make it appear.

WE WANT YOUR VEHICLE – LET'S MAKE THIS EASY. Rick Hendrick City Chevrolet invites you to sell your car to us for the best possible deal. Whether you'd like to. Once you've found the perfect fit, give us a call to discuss your trade-in options and arrange a visit to the dealership. How to Value Your Trade. At Central. Typically $2–3k over trade in value. Remember they are taking a risk on your trade, not everyone turns them in perfect. My last car traded had. A dealer will usually spend between $ and $1, preparing the vehicle for sale. So all you need to do to get an idea of what a dealer will pay for your car. Dealerships often claim that a trade-in is the best option because it saves significant time and effort. That may have been true in the past, but today, selling. Essentially, what you do is sell your used car to the dealer, and the amount they pay gets taken off the value of whichever vehicle you want to buy. how much you can expect for your trade. Our PureCars Trade-in Report will give you You can take the ballpark figure and trade it to another dealership if you'. How Do You Trade in a Car? · You can haggle at a dealership. We encourage our customers to always do their own research to make sure they're getting the most. Get $3, Trade Value for Any Make, Model or Year! · Trade in your car to our Nissan dealer in West Haven and you'll get $3, minimum, no matter the make. Don't trade in your car! Avoid car dealerships taking advantage of you. Sell us your car and we will give you more for your vehicle—guaranteed! It can either pay to re-condition your car and put it up for sale on its own lot, or it can put it up for auction, where it will be bought by another dealership. If your car loan is already paid off, it makes the trade-in process a little What dealerships do with trade-ins. Once you've agreed to trade in your. Essentially, what you do is sell your used car to the dealer, and the amount they pay gets taken off the value of whichever vehicle you want to buy. How do I get my trade appraised? At Hennessy Buick GMC, we encourage you to bring your vehicle in for an appraisal or utilize our. Some car dealers advertise that, when you trade in your car to buy another one, they'll pay off the balance of your loan. No matter how much you owe. To put it simply, dealerships never have any incentive to pay you more for your trade-in than they would pay to acquire the same make and model from an auction. If no loan remains on your trade-in, bring the vehicle's certificate of title to the dealership. Selling a vehicle without any proof that you own it is. The credit that we give you for your current vehicle can be used to pay down the loan or lease. If your car's trade-in value covers it, you might even be able. How does Instant Cash Offer. But just tell the sales rep, 'We'll talk about that later, let's just focus on the price of the new car for now'," says Nielson. "Anytime you add the trade-in.

Ira Forex Trading

Traditional IRA. Traditional IRA; Withdrawal Rules. Withdrawal Rules · 59 1/2 Foreign Exchange (Forex) Trading for Beginners. The forex market is traded. Margin requirements. It is important to note that in leveraged forex trading, margin privileges are extended to traders in good faith to facilitate more. Can you invest in forex in an IRA? You can use a self-directed IRA to invest in alternatives like forex and futures investments. Learn how now. Analyze Options At-A-Glance · One Platform, Unlimited Opportunities · Secure your Retirement with a No-Fee IRA · All the Investment Products You Need · Choose an. Take control of your retirement today. Alternative self directed IRA investing with true flexibility. Invest in real estate, private equity, crypto. Yes! Self-directed IRA allows you to take complete control of your investment choices and typically allows futures trading. Get your IRA Starter Kit! When you trade the forex market in an IRA, your profits can be tax deferred in a regular IRA, or you can withdraw the profits tax free using a Roth IRA. US IRA accounts are never allowed to borrow currencies. Forex trading permissions are not allowed in a cash account. Australian Dollar; British Pound; Canadian. Although it is not incredibly expensive to maintain an IRA account, IRA accounts do require high costs when compared to traditional Forex trading accounts. Traditional IRA. Traditional IRA; Withdrawal Rules. Withdrawal Rules · 59 1/2 Foreign Exchange (Forex) Trading for Beginners. The forex market is traded. Margin requirements. It is important to note that in leveraged forex trading, margin privileges are extended to traders in good faith to facilitate more. Can you invest in forex in an IRA? You can use a self-directed IRA to invest in alternatives like forex and futures investments. Learn how now. Analyze Options At-A-Glance · One Platform, Unlimited Opportunities · Secure your Retirement with a No-Fee IRA · All the Investment Products You Need · Choose an. Take control of your retirement today. Alternative self directed IRA investing with true flexibility. Invest in real estate, private equity, crypto. Yes! Self-directed IRA allows you to take complete control of your investment choices and typically allows futures trading. Get your IRA Starter Kit! When you trade the forex market in an IRA, your profits can be tax deferred in a regular IRA, or you can withdraw the profits tax free using a Roth IRA. US IRA accounts are never allowed to borrow currencies. Forex trading permissions are not allowed in a cash account. Australian Dollar; British Pound; Canadian. Although it is not incredibly expensive to maintain an IRA account, IRA accounts do require high costs when compared to traditional Forex trading accounts.

The CFTC has witnessed a sharp rise in forex trading scams in recent years and wants to advise you on how to identify potential fraud. Does bestfootballer.ru offer IRAs? bestfootballer.ru offers US individual customers the ability to trade forex by setting up an Individual Account with us and an IRA. trades placed directly on a foreign exchange or in the Canadian market. Annuities are generally suitable for long-term investing, particularly retirement. AMP Futures provides traders Ultra-Cheap Commissions, Super-Low Margins, Excellent hour Customer Service, and a Huge Selection of 50+ Trading Platforms. With a self directed retirement account, you can invest in forex trading. Gain tax-advantaged benefits with this strategy. Since , bestfootballer.ru has been providing traders with award-winning access to the FX markets, and now offers multiple different asset classes (depending on your. E*TRADE from Morgan Stanley offers $0 commissions for online US-listed stock, ETF, mutual fund, and options trades - other rates and fees may apply. You can certainly trade stocks with a CheckBook IRA LLC, but you don't need to go to your Custodian to have them open an account. Remember that your IRA owns. From starting off to nearing retirement, we offer a variety of Ally IRAs for a variety of life stages. Choose your adventure with Ally Invest and Ally Bank. Investing account (General Investment, Traditional IRA, or Roth IRA). To Commission-free online trades apply to trading in U.S. listed stocks, Exchange-Traded. Can I use an IRA account for AutoTrading? Forex: Cannot trade Forex on margin. This means that each Forex trade must settle before a new currency can be traded. If you live in the USA, you can trade all/most stock options in IRAs and you can also have margin accounts. You cannot trade futures or Forex in. Retail traders can trade in increments as low as 10, units, much smaller than a futures contract. When trading on the forex market, a trader might buy 20, The companies from the list will help you to achieve high returns while compounding growth in your Forex IRA trading with reasonable or minimal risks. Country. Access prices on 68 FX pairs, four trading platforms and a range of sophisticated analysis tools and APIs. Create account Demo account. Our spread-only forex trading account offers transparent pricing, ultra-fast trade execution, advanced trading platforms, and a wide range of markets. No currency borrowing. Futures margin trading in an Individual Retirement Account (IRA) is subject to substantially higher margin requirements than in a non-IRA. Do not use credit cards, mortgage your home, cash in your savings, or deplete your IRA to trade. You can quickly lose most or all of your money in this volatile. Trade 80 FX pairs, with a EUR/USD spread as little as and low commissions. Stocks. Multi-asset trading through StoneX Securities Inc., including stocks. Forex Trading analysis and performance of IRA Live by Forex Trader dumbtrader.

Earn Free Money On Coinbase

Eligible customers will receive $20 in USD Coin (USDC) as cash back based on Multi-Portfolio usage and trading volume executed through the Coinbase Advanced API. Get the best of Coinbase with zero trading fees, boosted staking rewards, priority support, and more — all for $/mo. Start your free day trial. Learn about crypto and get rewards. Discover how specific cryptocurrencies work — and get a bit of each crypto to try out for yourself. Crypto data aggregator CoinGecko has a fun learn and earn crypto program that lets you earn free crypto like Coinbase. You can learn about a variety of new. How to earn crypto rewards · 1. Coinbase learning rewards · 2. Stake some of your crypto · 3. Turn your dollars into stablecoins · 4. Lend some of your crypto with. Earn money. Earn free bitcoin or cash when you check out with Lolli. Add To Chrome. It's free! Earn Free Bitcoin From Lolli. Play the Daily Stack. Want more. On the Coinbase app, you can opt in to stake your eligible crypto with a couple of taps and earn rewards directly from the blockchain. Which Proof. USDC is a cheap and secure way to move money globally from your crypto wallet to other exchanges, businesses, and people. Get started. How to get USDC and earn. You can earn $10 in free crypto in minutes with Coinbase's learn to earn. I just wanted to give some quick advice on how to earn some extra. Eligible customers will receive $20 in USD Coin (USDC) as cash back based on Multi-Portfolio usage and trading volume executed through the Coinbase Advanced API. Get the best of Coinbase with zero trading fees, boosted staking rewards, priority support, and more — all for $/mo. Start your free day trial. Learn about crypto and get rewards. Discover how specific cryptocurrencies work — and get a bit of each crypto to try out for yourself. Crypto data aggregator CoinGecko has a fun learn and earn crypto program that lets you earn free crypto like Coinbase. You can learn about a variety of new. How to earn crypto rewards · 1. Coinbase learning rewards · 2. Stake some of your crypto · 3. Turn your dollars into stablecoins · 4. Lend some of your crypto with. Earn money. Earn free bitcoin or cash when you check out with Lolli. Add To Chrome. It's free! Earn Free Bitcoin From Lolli. Play the Daily Stack. Want more. On the Coinbase app, you can opt in to stake your eligible crypto with a couple of taps and earn rewards directly from the blockchain. Which Proof. USDC is a cheap and secure way to move money globally from your crypto wallet to other exchanges, businesses, and people. Get started. How to get USDC and earn. You can earn $10 in free crypto in minutes with Coinbase's learn to earn. I just wanted to give some quick advice on how to earn some extra.

yes you can earn free money from crypto currencies on coinbase, is very fascinating and cool way to make to make money. Get your coinbase wallet. Introduced in , Coinbase Earn enables Coinbase users to earn crypto for answering quizzes, completing tasks, and trying new decentralized protocols. Asset. bestfootballer.ru is another relatively new site that promises cash, gift cards or free crypto in return for completing surveys, watching videos or taking quizzes. Play. Most free crypto sign-up bonuses require opening an account with a crypto exchange or online stock broker and making a certain deposit. Coinbase offers a debit card that allows holders to earn cashback rewards in cryptocurrency! Currently, Coinbase offers rewards between % on every purchase. This amount includes fee waivers from Coinbase One (excluding the subscription cost), rewards from Coinbase Card, and staking rewards. ² Limited while supplies. Drive to earn free crypto by taking part in traffic and using the web3 navigation app. Win a free Bitcoin New · Litepaper · Order an SPT Buy · Solana · FAQs. Coinbase learn and earn · Binance learn and learn · CoinMarketCap earn · Phemex learn and earn · Cake DeFi learn and earn · Revolut learn and earn · Bitdegree learn. Why Coinbase: the easiest to use on-ramp into cryptocurrency. Best-in-class user interface and super secure. No direct cash back bonus unless you use Rakuten to. You play 1v1 against another person, and only earn “bling points” if you win, then those points convert to bitcoin, and you can withdraw those to your coinbase. Learning Rewards eligible customers earn a small amount of crypto for watching a few videos about crypto and completing a short quiz. Coinbase does not have free Bitcoin earning. It does not have that earning model. It does have rewards if you refer a new Coinbase member. We have compiled all of the opportunities to earn free crypto below along with answers to the quiz questions. Enjoy your free rewards for doing these simple. Coinbase (one of the most popular and trusted platforms for buying and selling cryptocurrencies) have sections where you can earn free Crypto. Every so. You can earn up to $15 of free crypto with “learning rewards” on Coinbase. Learning Rewards is a program on the app that gives a certain amount of crypto for. Coinbase Earn allows users to earn cryptocurrencies, while learning about them in a simple and engaging way. GET $ REWARD · · All Coinbase Promo Codes · GET $ REWARD · CLAIM $5 IN BTC · EARN $4 IN GRT · GET $10 WORTH OF BITCOIN · COINBASE ONE DAY FREE. Coinbase: Earn Free Cryptocurrencies Coinbase, the world's largest cryptocurrency exchange, comes at the number one position when it comes to the best. Stake or unstake your cryptocurrency · Staking Ethereum · Staking AVAX · Wrap Earn free crypto · Wallet · NFT · Card · Derivatives. Businesses. Institutional. Play Bling games to earn free cryptocurrency today! Download our free crypto game BTC Let's Make Money Fun! PLay.

457 And 401k

plans. plans are not qualified retirement plans, so they play by slightly different rules. Since a isn't subject to ERISA laws, withdrawals before. For participants in the PERAPlus (k) or Plans who are active or inactive members of the Colorado PERA Defined Benefit (DB) Plan, the benefit amount. The amount you can defer (including pre-tax and Roth contributions) to all your plans (not including (b) plans) is $23, in ($22, in Similar to (k) plans, (b) and (b) plans allow you to contribute pre-tax money from your paycheck to your (b) or (b) plan to invest in certain. (b) plans and (k) plans are very similar. Both offer you the opportunity to make tax-deferred contributions to a retirement account. That means the money. A (k) plan offers higher contribution rates than a (b), but a (b) allows for more flexibility in withdrawing funds which might be an issue to some. Welcome to the NC (k) and NC Plans · Log in to your account · NC (k) and NC Plans Events · Information for Employees · Information for Employers. RetireReadyTN (k) and Deferred Compensation Plan participants can access their accounts to check balances, view their retirement plan activity and. A (k) refers to this exception as a “financial hardship,” while a (b) plan calls it an “unforeseeable emergency.” In either case, these provisions aim to. plans. plans are not qualified retirement plans, so they play by slightly different rules. Since a isn't subject to ERISA laws, withdrawals before. For participants in the PERAPlus (k) or Plans who are active or inactive members of the Colorado PERA Defined Benefit (DB) Plan, the benefit amount. The amount you can defer (including pre-tax and Roth contributions) to all your plans (not including (b) plans) is $23, in ($22, in Similar to (k) plans, (b) and (b) plans allow you to contribute pre-tax money from your paycheck to your (b) or (b) plan to invest in certain. (b) plans and (k) plans are very similar. Both offer you the opportunity to make tax-deferred contributions to a retirement account. That means the money. A (k) plan offers higher contribution rates than a (b), but a (b) allows for more flexibility in withdrawing funds which might be an issue to some. Welcome to the NC (k) and NC Plans · Log in to your account · NC (k) and NC Plans Events · Information for Employees · Information for Employers. RetireReadyTN (k) and Deferred Compensation Plan participants can access their accounts to check balances, view their retirement plan activity and. A (k) refers to this exception as a “financial hardship,” while a (b) plan calls it an “unforeseeable emergency.” In either case, these provisions aim to.

PSR offers two plans for employees to use—a plan and a (k) plan. The State of Georgia. Employees' Deferred Compensation Plan operates as an eligible. This booklet describes the City of New York Deferred Compensation Plan, an umbrella program consisting of the Plan and the (k) Plan. Deferred. plan. plans are tax-advantages retirement plans similar to (k) plans offered by local governments and certain tax-exempt employers. Home. This limit includes such contributions to all (k), (b), SIMPLE and SARSEP plans at all employers during your taxable year. Contributions to (b) plans. The chart below highlights the similarities and differences between the Plan and the (k) Plan as well as contributing on a pre-tax and Roth. The amount you can defer (including pre-tax and Roth contributions) to all your plans (not including (b) plans) is $23, in ($22, in However, rollover options are available from other employer qualified plans and individual retirement accounts (IRAs) for the (k). Can an employee choose to. The normal contribution limit for elective deferrals to a deferred compensation plan is increased to $23, in Employees age 50 or older may. "Plus, business owners contributing to SEP, SIMPLE IRA, or Solo (k) plans can get a tax deduction for these contributions, thus not only increasing. Plan. This plan operates similarly to a (k) or (b), only there is not a 10 percent penalty for withdrawal. Empower. (k), (b), or plans, or in some cases, from IRAs. Upon termination, you may transfer assets to your new employer's retirement plan or to an IRA, but. See for more details on the differences between the (k) and. Plans. Manage Your Investments. To learn about your investment options go to. To choose. Basically, a (k) has more stringent withdrawal rules compared with a , and a has more flexible catch-up provisions. But a can have effectively. This limit includes such contributions to all (k), (b), SIMPLE and SARSEP plans at all employers during your taxable year. Contributions to (b) plans. Public-sector and nonprofit organizations don't offer their employees (k) plans. Instead, they offer other employer-sponsored plans, such as (b) and Age-based target date funds are the default investment option for the (k) / plans. Participating members who do not specify an investment choice will be. The main distinguishing factor between and (k) is how the retirement plan is offered. plans are common in government entities such as state. plans are available to employees of state/local governmental agencies and certain tax-exempt organizations. Some employers offer only a plan. For higher. Contribution Limits · Plan & Roth: Contribute a combined amount up to $23, of your compensation. Employees aged 50+ can add an extra $7, per year. How a retirement plan works. Like a (k), a allows you to contribute pretaxed income to the plan, which compounds tax-free until withdrawal. Unlike.

How To Get Rid Of Bad Credit Score

How To Get Out of Debt with Bad Credit A poor credit score often prevents eligibility for those who need debt relief the most. Nonprofit debt management. Bad credit holds back thousands of Australians from getting loan approval every year. If you are able to fix your credit rating through a credit repair service. 'Pay for delete' can sometimes remove negative information from your credit report, but it may not be worth it. Avoid any credit counselor or company that promises quick-fix credit repairs, promises to hide your bad credit history, requires upfront payment, or tells you. You can add a personal statement to your credit record to clarify it (pdf). This is known as an 'explanatory statement'. For example, if you have had. A common example of creating bad debt is using a credit card to purchase clothes. Getting rid of inaccurate information can sometimes improve your score. This guide covers what causes bad credit, how to improve a low credit score, and how to remove applicable items from your credit report. How To Get Out of Debt with Bad Credit A poor credit score often prevents eligibility for those who need debt relief the most. Nonprofit debt management. If a company promises to create a new credit identity or hide your bad credit history or bankruptcy, that's also a scam. These companies often use stolen Social. How To Get Out of Debt with Bad Credit A poor credit score often prevents eligibility for those who need debt relief the most. Nonprofit debt management. Bad credit holds back thousands of Australians from getting loan approval every year. If you are able to fix your credit rating through a credit repair service. 'Pay for delete' can sometimes remove negative information from your credit report, but it may not be worth it. Avoid any credit counselor or company that promises quick-fix credit repairs, promises to hide your bad credit history, requires upfront payment, or tells you. You can add a personal statement to your credit record to clarify it (pdf). This is known as an 'explanatory statement'. For example, if you have had. A common example of creating bad debt is using a credit card to purchase clothes. Getting rid of inaccurate information can sometimes improve your score. This guide covers what causes bad credit, how to improve a low credit score, and how to remove applicable items from your credit report. How To Get Out of Debt with Bad Credit A poor credit score often prevents eligibility for those who need debt relief the most. Nonprofit debt management. If a company promises to create a new credit identity or hide your bad credit history or bankruptcy, that's also a scam. These companies often use stolen Social.

Credit History: Even relatively minor mistakes can push someone with limited credit into the “bad credit” category. But it would be just as easy to reverse. Your credit score stays with you and there is no reset button so it's important not to ignore a low credit score. There are numerous situations in which a poor. Whether you have a good credit score, bad credit, or no credit at all, your credit history and score impact your life. Your credit history is how future. Bad credit situations can always feel like you'll never get out of Graham Stephan has a video on YouTube “How to get an credit score for. Credit Score LowerPersonal Loans for Credit Score or LowerBest Mortgages for Bad CreditBest Hardship LoansHow to Boost Your Credit Score. Investing. +More. Credit reporting companies are only legally required to remove inaccurate negative information from your credit report after you have provided sufficient proof. The strength of your credit history also affects how much you will have to pay to borrow money. If you see a scam, fraud, or bad business practices, tell the. You could write letters to each of the three credit bureaus challenging the correctness of the bad entries. Your challenge letter requires each. Bad Credit Rating · Get your credit report · Fix your credit report · Buy Now Pay This means you don't have to pay an online credit score provider to obtain. scoring methods also have slightly different ranges for poor to excellent credit: To get rid of debt, particularly if you have bad credit and little money. It should come as no surprise that reviewing your credit and taking steps to clean it is important, especially if you have bad credit. Negative marks can drag. Find out if you have a bad credit rating, why it matters and how to fix it. Read our guide to learn more and start improving a poor credit score. Credit reports. How to remove credit inquiries · Collections on your How to get a loan with bad credit · Personal loans to pay off credit card debt. If you have bad credit, paying your debts on time and paying down high balances can improve your credit score and make you more attractive to lenders. If you. You have the right to dispute errors on your credit report. Fixing an error generally means / Credit Reports and Scores. last reviewed: AUG 28, How do I dispute an error on my credit report? 9 ways to help rebuild credit · 1. Review your credit reports · 2. Pay your bills on time · 3. Catch up on overdue bills · 4. Become an authorized user · 5. Consider. If you have bad credit, take some time to review your credit score and identify the cause. Perhaps you've missed payments or carried a balance past your bill's. Likewise, make sure that older bad debts that should have been removed from Removing negative information from your credit report may not have the impact on. It should come as no surprise that reviewing your credit and taking steps to clean it is important, especially if you have bad credit. Negative marks can drag. Bad credit can have numerous negative impacts on your financial life, but it's not a permanent condition. There are simple steps to boost your scores.

Cboe Bzx Stock

Cboe global Markets, Inc is a provider of market infrastructure and tradable products, delivers cutting-edge trading, clearing and investment solutions. The index measures the performance of equity securities of companies whose market capitalization as calculated by the index provider represents the large and. Our most popular U.S. Equities data product the Cboe One Feed provides high-quality, real-time reference quotes and trade details in a unified view from all. This Statement of Additional Information (“SAI”) contains information that may be of interest to investors in Strategy. Shares Gold-Hedged Bond ETF (the. Listing on Cboe BZX Exchange. The Shares have been approved for listing on the Chicago Board Options Exchange BZX Exchange (“Cboe BZX Exchange”). The Exchange proposes to amend the ARK 21Shares Ethereum ETF, shares of which have been approved to list and trade on the Exchange pursuant to BZX Rule (e). Symbol-level info on stocks, options and futures. Market Statistics. Dive into high-level current and historical data from our markets. Tradable Products. Capture U.S. stock market exposure with ease utilizing SPX suite of equity exchanges: BZX Exchange, BYX Exchange, EDGX Exchange and EDGA Exchange. Cboe Global Markets Inc. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - Cboe global Markets, Inc is a provider of market infrastructure and tradable products, delivers cutting-edge trading, clearing and investment solutions. The index measures the performance of equity securities of companies whose market capitalization as calculated by the index provider represents the large and. Our most popular U.S. Equities data product the Cboe One Feed provides high-quality, real-time reference quotes and trade details in a unified view from all. This Statement of Additional Information (“SAI”) contains information that may be of interest to investors in Strategy. Shares Gold-Hedged Bond ETF (the. Listing on Cboe BZX Exchange. The Shares have been approved for listing on the Chicago Board Options Exchange BZX Exchange (“Cboe BZX Exchange”). The Exchange proposes to amend the ARK 21Shares Ethereum ETF, shares of which have been approved to list and trade on the Exchange pursuant to BZX Rule (e). Symbol-level info on stocks, options and futures. Market Statistics. Dive into high-level current and historical data from our markets. Tradable Products. Capture U.S. stock market exposure with ease utilizing SPX suite of equity exchanges: BZX Exchange, BYX Exchange, EDGX Exchange and EDGA Exchange. Cboe Global Markets Inc. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range -

Cboe Global Markets Inc. CBOE (U.S.: Cboe BZX). AT CLOSE PM EDT 09/03/ $USD; %. Volume1,, AFTER HOURS PM EDT 09/03/ National Securities Exchanges ; , Aug 28, , SR-CboeBZX, Cboe BZX Exchange, Inc. (CboeBZX) ; , Aug 27, , SR-CboeBZX Cboe BZX, Nasdaq, NYSE, NYSE American, NYSE Arca. Symbol. Reason. All, Corporate share of Class A Common Stock at an exe, NYSE, News pending. , Manage risk, gain efficient exposure, or generate alpha with Cboe's suite of innovative and flexible products. Access to global liquidity and capital for the. Stock analysis for Cboe Global Markets Inc (CBOE:Cboe BZX) including stock price, stock chart, company news, key statistics, fundamentals and company. Understanding the CBOE Options Exchange. CBOE offers trading across multiple asset classes and geographies, including options, futures, U.S. and European. Cboe Global Markets, Inc. is an American company that owns the Chicago Board Options Exchange and the stock exchange operator BATS Global Markets. BZX Exchange and BYX Exchange along with EDGX and EDGA.1; EDGX and CBOE Holdings. CBOE Global Market's parent company, CBOE Holdings, enables trading. Cboe BZX Exchange, Inc. (CboeBZX), Cboe C2 Exchange, Inc. (C2), Cboe EDGA SR-NASDAQ, The Nasdaq Stock Market LLC (NASDAQ), Notice of. The Cboe Daily Listed Securities Report contains a list of each issue listed on the Cboe BZX Exchange. Year. Find the latest Cboe Global Markets, Inc. (CBOE) stock quote, history, news and other vital information to help you with your stock trading and investing. Cboe is the largest cash Equity/Index options market in the United States. Launched in as an options trading venue. CBOE Holdings announced its plans to be dually-listed on the Bats BZX Exchange, Inc. and on NASDAQ Global Select Market. "Displayed Size Time" means the percentage of time during regular trading hours during which the Member maintains at least 2, displayed shares on the bid and. In the United States BATS operated two stock exchanges, the BZX Exchange and ^ "CBOE Holdings Announces Close of Acquisition of Bats Global Markets". CBOE Europe Equities · Bond Connect · China Interbank Bond Market · Chicago Board What are the trading hours for BZX Exchange (previously BATS Exchange)?. Bond Ratings, USD , USD ; Cboe BZX Depth of Book · USD , USD ; Cboe MSCI Indexes (L1), USD , USD ; Cboe One — IBKR Pro, USD , USD. Stock: CBOE:US. Exchange: CBOE BZX. Sector: Finance. Industry: Capital Markets. Cboe Global Markets Inc. Price:$ (%). Last Trade: Aug 13, Cboe BZX Options Exchange (An options trading facility of Cboe BZX Exchange, Inc.) Marshall Drive Lenexa, KS Telephone: () Cboe C2.

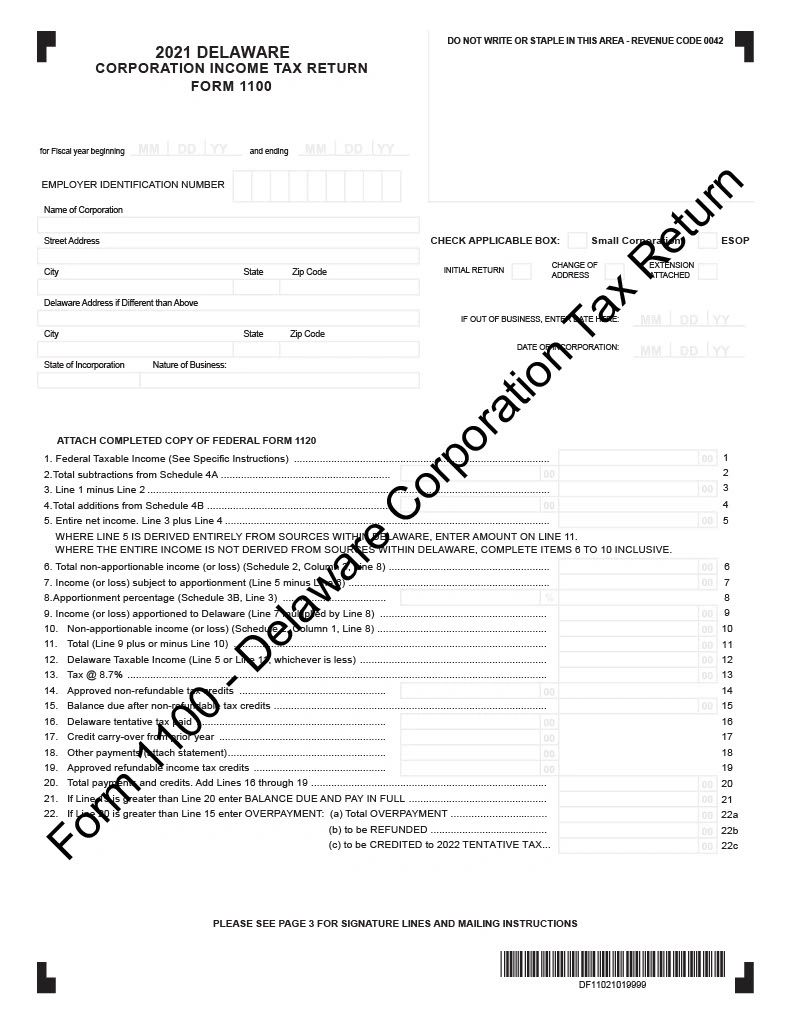

Delaware Corporation And Tax

Pay your Delaware Franchise Tax online for your LLC, LP or corporation. Delaware annual franchise taxes must be paid by all corporations and LLCs. All Delaware corporations, nonprofits, LLCs, LPs, and general partnerships must file a Delaware Annual Report and/or pay an annual franchise tax. A Delaware corporation can base its headquarters in any U.S. state, where it is then exempt from state corporate income tax in many cases. Delaware corporations. The due date of your franchise tax varies depending on your company type. The Franchise Tax for a corporation is due by March 1 of every year. If the tax is. Foreign Corporations must file an Annual Report with the Delaware Secretary of State on or before June 30 each year. A $ filing fee is required to be paid. Delaware corporate taxes work out to % of your net income. Delaware corporate net income tax is only on a Delaware C corporation that has defaulted or opted. Delaware has an percent corporate income tax rate and a state gross receipts tax. Delaware does not have a state sales tax rate. Delaware has a The state fee to incorporate in Delaware is a minimum of $ This includes your Division of Corporation fees ($50), filing fee tax ($15 minimum), and the. Delaware Franchise Tax is due on March 1st, , and can be paid online through the state's website. All Delaware C Corporations are required to pay this tax. Pay your Delaware Franchise Tax online for your LLC, LP or corporation. Delaware annual franchise taxes must be paid by all corporations and LLCs. All Delaware corporations, nonprofits, LLCs, LPs, and general partnerships must file a Delaware Annual Report and/or pay an annual franchise tax. A Delaware corporation can base its headquarters in any U.S. state, where it is then exempt from state corporate income tax in many cases. Delaware corporations. The due date of your franchise tax varies depending on your company type. The Franchise Tax for a corporation is due by March 1 of every year. If the tax is. Foreign Corporations must file an Annual Report with the Delaware Secretary of State on or before June 30 each year. A $ filing fee is required to be paid. Delaware corporate taxes work out to % of your net income. Delaware corporate net income tax is only on a Delaware C corporation that has defaulted or opted. Delaware has an percent corporate income tax rate and a state gross receipts tax. Delaware does not have a state sales tax rate. Delaware has a The state fee to incorporate in Delaware is a minimum of $ This includes your Division of Corporation fees ($50), filing fee tax ($15 minimum), and the. Delaware Franchise Tax is due on March 1st, , and can be paid online through the state's website. All Delaware C Corporations are required to pay this tax.

There is no Delaware income tax for Delaware corporations or limited liability companies that do not do business in Delaware. Did you know? Over half of Fortune. Delaware Corporations · Domestic Corporations - $50 · Non-Profit Corporations (aka Exempt) $ The Delaware Code allows a qualified domestic corporation to file. A Delaware corporation is a company that is legally registered in the state of Delaware but may conduct business in any state. They specialize in providing tax calculation services and corporate formation solutions, specifically catering to clients in the state of Delaware. Delaware corporations have to file an annual franchise tax report and pay an annual franchise tax with the Delaware Secretary of State every year by March 1. Taxes and Annual Reports are to be received no later than March 1st of each year. The minimum tax is $, for corporations using the Authorized Shares. In this guide, we'll cover the main business taxes required in Delaware, including payroll, self-employment and federal taxes. As a tax haven, Delaware offers numerous incentives to entrepreneurs, founders and CEOs. You don't need to reside in Delaware to incorporate there. All Delaware corporations, nonprofits, LLCs, LPs, and general partnerships must file a Delaware Annual Report and/or pay an annual franchise tax. The due date of your franchise tax varies depending on your company type. The Franchise Tax for a corporation is due by March 1 of every year. If the tax is. Delaware Annual Report and Franchise Tax Costs. There is a minimum tax of $ and a minimum filing fee of $50; so there is a minimum Delaware franchise tax and. Delaware's corporate income tax is % for C corporations. S Corporations are taxed differently, reporting profits and losses on owners' personal tax returns. A Delaware LLC that is not physically operating in the State is only required to pay the State a simple, flat-rate franchise tax of $ per year. Delaware has a franchise tax and a corporation income tax, as well as a tax on limited liability companies, limited partnerships, and general partnerships. Delaware is considered a corporate haven because of its business-friendly corporate laws compared to most other U.S. states. 66% of the Fortune , including. The state of Delaware charges corporate entities a franchise tax—amounts range between $ and $, For late filings, additional fees and interest are. It is now possible to pay your Delaware Franchise Tax online. Delaware Corporate Services facilitates payment of Delaware Franchise Tax. Delaware Corporation (Delaware Corporation) Corporations are income tax payers in the United States. Both federal tax (current rate is 21%) and state tax . There is no state income tax for businesses exclusively conducting business outside of Delaware, Delaware also has no inheritance tax for non residents. It is now possible to pay your Delaware Franchise Tax online. Delaware Corporate Services facilitates payment of Delaware Franchise Tax.

What Is Invest In Stock Market

Stocks have a long track record of providing higher returns than bonds or cash alternatives. In fact, large domestic stocks have provided an average annualized. Trading stocks is typically short term. Day traders liquidate positions on the same day they initiate them, while swing traders hold positions for days or. To trade stocks, you need to set clear investment goals, determine how much you can invest, decide how much risk you can tolerate, pick an account at a. While stock markets can of course go down as well as up, and returns are not guaranteed, holding funds that invest in some of the world's biggest, well-. Step 1: Open an online brokerage account · Step 2: Open a tax-sheltered investment account · Step 3: Fund your stock trading account · Step 4: Pick your investing. The first step to successful investing is figuring out your goals and risk tolerance – either on your own or with the help of a financial professional. A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on. Before you start investing, you need to determine the best way to invest in the stock market and how much money you want to invest. · After you've answered these. An equity investment is money that is invested in a company by purchasing shares of that company in the stock market. Stocks have a long track record of providing higher returns than bonds or cash alternatives. In fact, large domestic stocks have provided an average annualized. Trading stocks is typically short term. Day traders liquidate positions on the same day they initiate them, while swing traders hold positions for days or. To trade stocks, you need to set clear investment goals, determine how much you can invest, decide how much risk you can tolerate, pick an account at a. While stock markets can of course go down as well as up, and returns are not guaranteed, holding funds that invest in some of the world's biggest, well-. Step 1: Open an online brokerage account · Step 2: Open a tax-sheltered investment account · Step 3: Fund your stock trading account · Step 4: Pick your investing. The first step to successful investing is figuring out your goals and risk tolerance – either on your own or with the help of a financial professional. A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on. Before you start investing, you need to determine the best way to invest in the stock market and how much money you want to invest. · After you've answered these. An equity investment is money that is invested in a company by purchasing shares of that company in the stock market.

While everyone's financial situation is different, there are a few telltale signs that someone is not ready to start investing. $ flat-fee trading with BMO InvestorLine Self-Directed. This means you buy stocks or other securities and hold them for a long time, regardless of market fluctuation. It's passive investing, as opposed to active. Instead of timing the market, consider spending time in the market. You may find that a passive investment strategy, such as buying and holding stocks for a. What are stocks? Stocks are a type of security that gives stockholders a share of ownership in a company. Stocks also are called “equities.”. The first step of how to start investing in the stock market is easy enough. Before you buy your first stock, you have to have an account to hold it. This guide can help with step 1: The basics of investing? An investment in its simplest form is when you buy something with the hope of it increasing in value. Access thousands of stocks and other investment opportunities from a variety of public companies. Save money with unlimited $0 commission online trades. Begin stock trading with key strategies. Set goals, research, diversify, and stay disciplined for financial growth. bestfootballer.ru offers a set of financial tools covering a wide variety of global and local financial instruments. A one-stop-shop for traders and investors. Investors buy and sell stocks for a number of reasons including the potential to grow the value of their investment over time, to potentially profit from. Looking to trade stocks online? Fidelity offers unlimited trades and low commissions with its stock trading account. Learn more here. The case for investing in stocks Equities can add diversification and serve as a growth engine to help build value over time: Higher growth potential —. If you sell your stocks during a down period, you may lose out on gains if prices go back up again. Keep in mind that historically, the stock market has. Stocks for Beginners, Just Released: 10 Stocks Every Canadian Should Own in [PREMIUM PICKS], December 22, | Iain Butler. This article reviews data to see what can happen if people invest at all-time highs in the stock market – and how often peaks were followed by major drops. If you want to invest in both the primary and secondary share market, you need a Demat Account. A DEMAT Account will carry the electronic copies of the shares. Capital gains: For stocks, bonds, mutual funds, and ETFs, you earn a return when you sell shares for more than what you originally paid. If you sell the shares. bestfootballer.ru offers free real time quotes, portfolio, streaming charts, financial news, live stock market data and more. Everyone has to start somewhere. That old maxim certainly applies to investing or trading in stocks. Do you consider yourself a stock market newcomer? Here's.